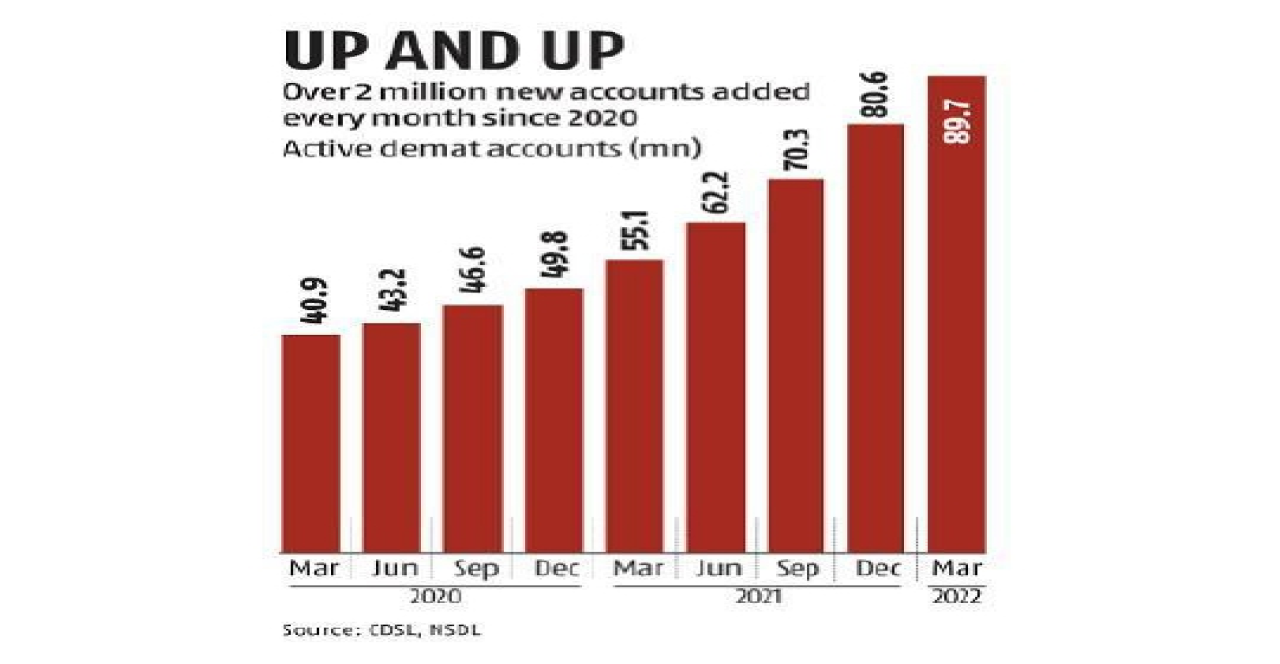

India had 89.7 million demat accounts at the end of this

fiscal. This number has jumped to 96.5 million demat

accounts at the end of June 2022. It is expected we will

reach 400 million demat accounts within a few years.

Imagine the inflows coming domestically!

India comes 5th

in current market cap to GDP ratio. Below

USA, China, Japan & Hong Kong. Our current market cap

to GDP ratio is ~100%. Our current GDP is $3tn. We are on

our way to reach $6tn GDP.

China reached from a $3tn economy to $6tn economy in 7 years (from 2001 to 2008). USA reached from a $3tn economy to a $6tn economy in 15 years (from 1961 to 1976). I am an eternal optimist and am quite sure we will reach a $6tn economy by 2032 (in the next 10 years). Also our financial savings are currently at $1tn. This will reach $3tn by 2030. Allocation to capital markets as a % of household savings is on the up and is bound to increase even further.

I am sure you are not listening to these stats for the first time. I am sure you would have heard that once we reach $5tn GDP, the magic starts to happen.

Guess what? The magic has already started to happen. Everyone who is reading this, think of the stuff you consumed 5 years back and what you consume now. Food, transportation, clothing, housing, education, recreation and on and on. And guess what, you don’t even drive the economy. The drivers of our economy is our big mean; our GDP per capita is $2000. It’s the people who earn Rs. 200,000 a year that drive the economy.

Listen to this guy, he has a message for you guys. Check this video:https://www.youtube.com/watch?v=Ao2E937Ebuc&ab_channel=IndiaToday

DO NOT MISS OUT on this major financialization of our economy. India and compounding are going to be good friends for the next decade.

THE MICRO: How do we make money?

- Buy Quality & Growth:As long as the sales and profitability of a company keep on increasing the price will follow. Valuation is important but ITS OKAY to buy stocks at expensive valuations. Remember, PE ratio is calculated based on current earnings. Analysts calculate PE ratio based on 2 or 3 years forward earnings. Companies that grow for the next decade will surpass its 2 or 3 year forward earnings by a mile! Also we haven’t even seen what euphoria looks like. Chances are you will see far higher valuation multiples on companies that continue to grow in the future.

- Ability to increase allocation to equities on corrections: I Professional investors who understand and are able to quantify risk, should definitely use leverage to their advantage. For people who do not want to leverage, should have a mechanism to allocate more capital to equities out of other asset classes. A simple example would be to buy Nifty ETFs to the tune of 10% of your current equity portfolio every time the markets fall 15% from its highs.

Parth Kotak, CFA, MSc. Finance.31th Aug 2022