Stuff that will lead the market higher:

- Inflation coming down

This is the short term flavour

There are too many things that are currently spooking the markets and will continue to scare investors. Some of these are just narratives that are driven by media where as some of these are a genuine concern.The single largest bogeyman that can really drive the markets down is SIGNIFICANT Quantitative Tightening.

The Fed’s tightening program will increase to $95 bn per month. Let’s look at this number in relation to 2 important matrices.

- Fed balance sheet

- Reverse Repo outstanding balance

Fed Balance Sheet

The Fed balance sheet increased from $4.1tn post pandemic to its high of $8.9tn in April 2022. This is a 120% increase in 2 years! The last time Fed increased its balance sheet from $2tn to $4tn was over a 10-year period beginning from 2010.

A $95bn tightening isn’t nearly enough to bring down the size of Fed balance sheet, M2 (Money supply) or velocity of money (In fact velocity of money will only increase by the virtue of its formula).

Reverse Repo Outstanding balance

The current reverse repo balance has increase to $2.18tn from virtually 0 pre-Covid (yes you read it right). The $95bn QT will take 2 years to just fade off the reverse repo balance. (If you are curious to read more about this, refer Kevin Muir’s article: https://www.washingtonpost.com/business/thefed-is-about-to-go-full-throttle-on-qt-fear-not/2022/08/31/7f1cdf94-2914-11ed-a90afce4015dfc8f_story.html)

How the macro will Play out??

I have a strong belief that inflation will come off. Housing prices have already started to come off and its lagged effect on owners’ equivalent rent will soon be reflected in the CPI number. The Fed eventually has a dual mandate to maximize employment & control inflation. Once inflation is under control (even virtually so as commodity & energy prices could continue to wreak havoc in the medium term) the Fed will Pivot.

- Daniel Kahneman, Thinking Fast & Slow.

Please now allow me to bore you with my almost uncanny optimism;

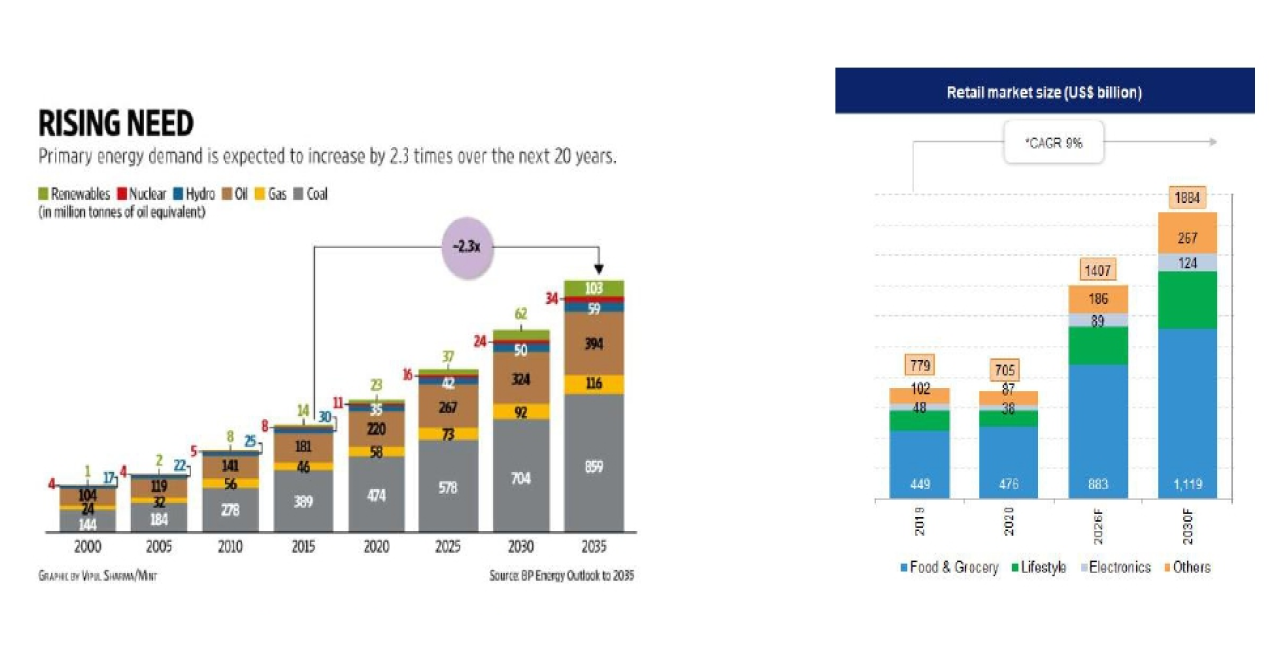

In the last month, I wrote about how India is expected to become a $6tn economy from a $3tn economy by 2030. Let me assure you, there will be more severe problems in the next decade to come than Fed’s QT. After taking that into consideration, we still by & large believe in India’s growth story.

As long as there are more stomachs to feed, the world as a whole will continue to increase productivity and generate more goods and services to satiate human needs. The next decade is a golden one for India as it has the best demographics that will drive consumption and productivity.

THE MICRO: How do we make money?

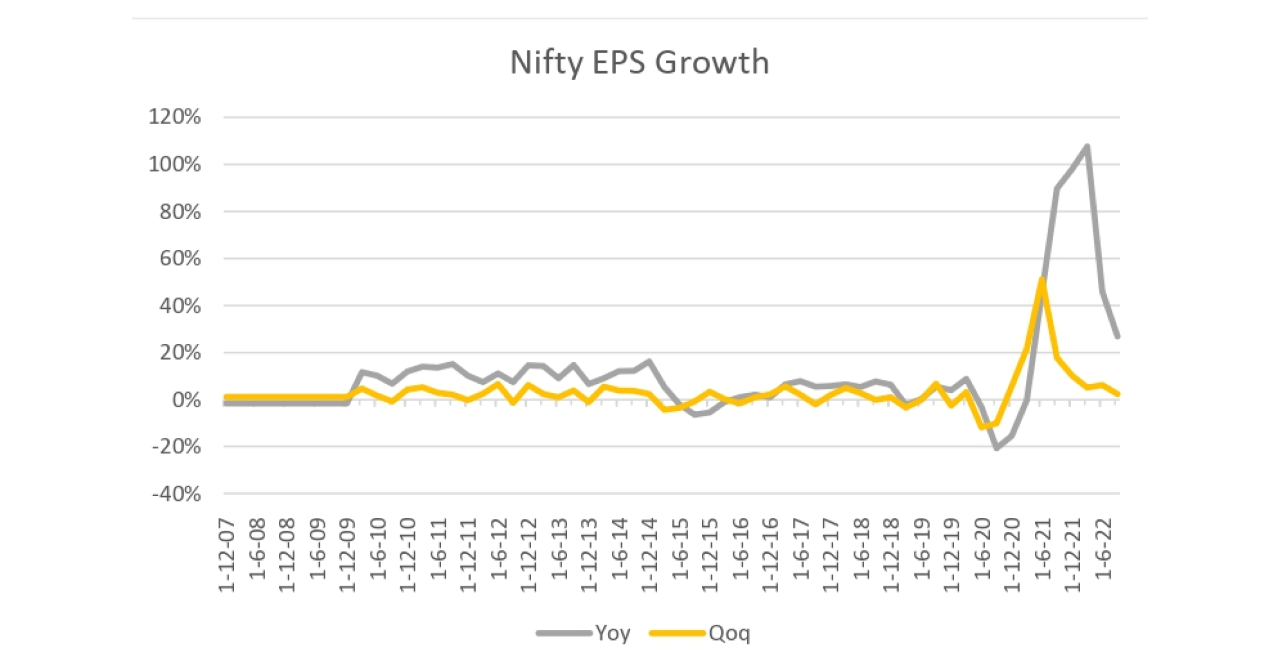

There are bright chances that Q2FY22 could see a de-growth in earnings

The only time Nifty EPS showed a meaningful (21% yoy) decline in earnings was during Covid.

It is of pivotal importance to have the ability to increase allocation to equities on corrections. Weather you do it with leverage or have the ability to do it without leverage is the question that you have to answer. It is very unlikely that Nifty EPS will decrease by double digits.

Also watch out for crypto currencies. My sense is Cryptos will correct meaningfully as the Fed tightens. Once the Fed pivots (which is a question of when and not if) crypto currencies can surge to newer highs.

Parth Kotak, CFA, MSc. Finance.30th Sep 2022