While there are evident problems faced by manufacturing sectors all over Europe, this remains a key positive for an emerging nation like India to become a global manufacturing hub.

I say that financial markets are taking the issue out of context as I couldn’t see any signs of slowdown in major European economies. Restaurants and Pubs and shopping malls, were flush with people. In fact, the issue which was the most glaring was SHORTAGE of labour.

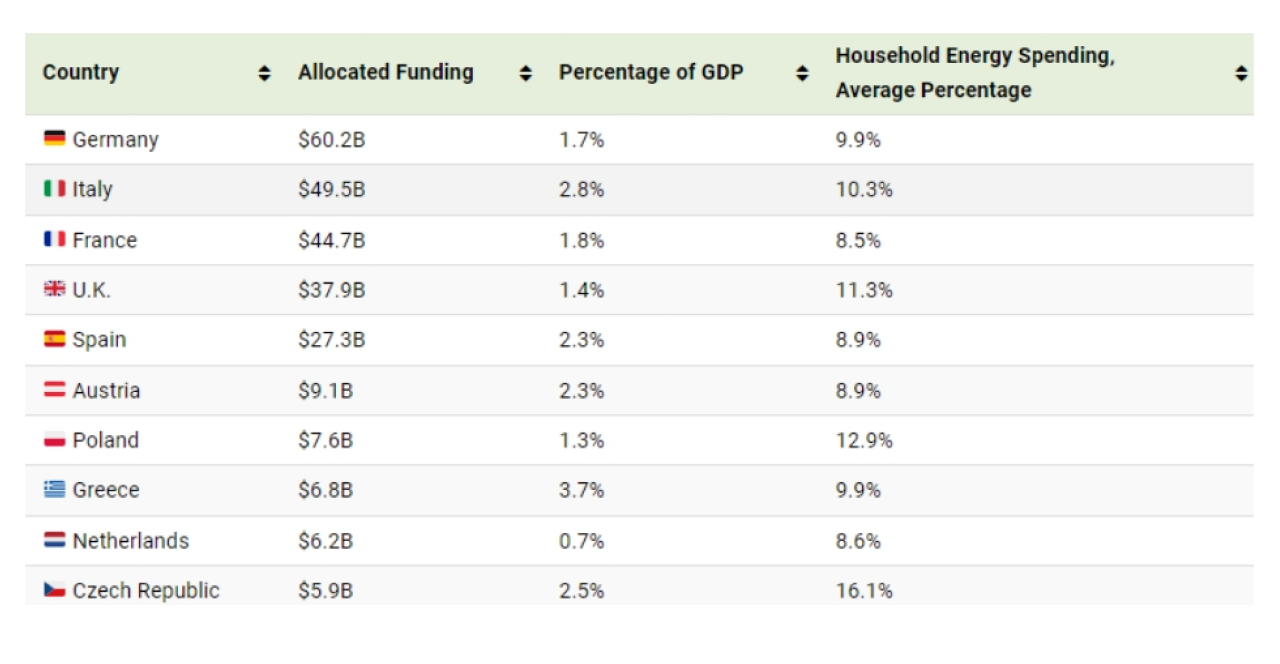

Around 193 million Europeans were pursuing a paid job in the first quarter of 2022, while some 74.5% of those aged 20-64 were in some sort of formal employment – the highest employment rate since Eurostat started publishing it in 2009. And the most recent data suggests that the figure has risen further in the second quarter of 2022.

At the same time, more than 3% of all available jobs are vacant – more than ever since statistical records of this data started in 2006 – meaning that around six million jobs are up for grabs across the EU. Correspondingly, the EU’s unemployment rate sank to 6.0% in July – another record figure since at least 2001, when Eurostat began compiling this data.

Let’s take a look at the US:

The latest data shows that we have over 10 million job openings in the US; but only six million unemployed workers. If every unemployed person in the country found a job, there would still be 4 million open jobs.

Unemployment level is at its lowest since 2002 and Job Openings are at their highest since the same time!

This leads to a slight change in my macro framework, structurally inflation will remain sticky. The Fed will stop raising rates and this WILL surely break our age old frameworks. Limited supply assets will go off the roof and there seems to be little evidence against this. (BITCOIN and prime real estate apart from equites).

THE MICRO: How do we make money?

I cannot stress enough the need for all portfolios to have exposure to India.

Q2FY23 results do not seem to be at their best. I have a feeling we will see a 5% correction in Indian indexes in the near term. This is nothing but an opportunity to invest more money in equities if you aren’t already fully invested.

As for one of the brightest spots is Telecoms! We are gearing up for the launch of 5G in India. This in my opinion will be the biggest disinflationary technological advancement of the coming decade.

Current rural tele density stands at 58.37 per cent and internet penetration in rural areas is 37.06 per cent. Blended ARPU increased from Rs.80 to Rs.127.2 from 2017 to 2022, still remains one of the lowest globally. Indian telcos have the lowest ARPU globally despite a reasonably high data consumption per SIM connection per month of around 15GB.

I would encourage you to read the report by KPMG on 5G to build some conviction in this thesis. (Link: https://assets.kpmg/content/dam/kpmg/in/pdf/2022/09/5g-driving-next-growth-wave-digitalindia-imc.pdf)

My sense is the telecom companies will transform in tech companies in many ways. They already have and continue to add fire power to acquire promising start-ups coming up with interesting innovations. Needless to say, the biggest gains for investors will be in the private unlisted space.

NB-IoT, LoRA, LTE-M, Zigbee, Sigfox are some technologies, which could work under the 5G umbrella and see some interesting innovations in utilises sensing technologies, such as 3D scanning; wearables, and collaborative robots and machines to support closed loop control systems, higher efficiency and safety.

Parth Kotak, CFA, MSc Finance. 6th Nov 2022.