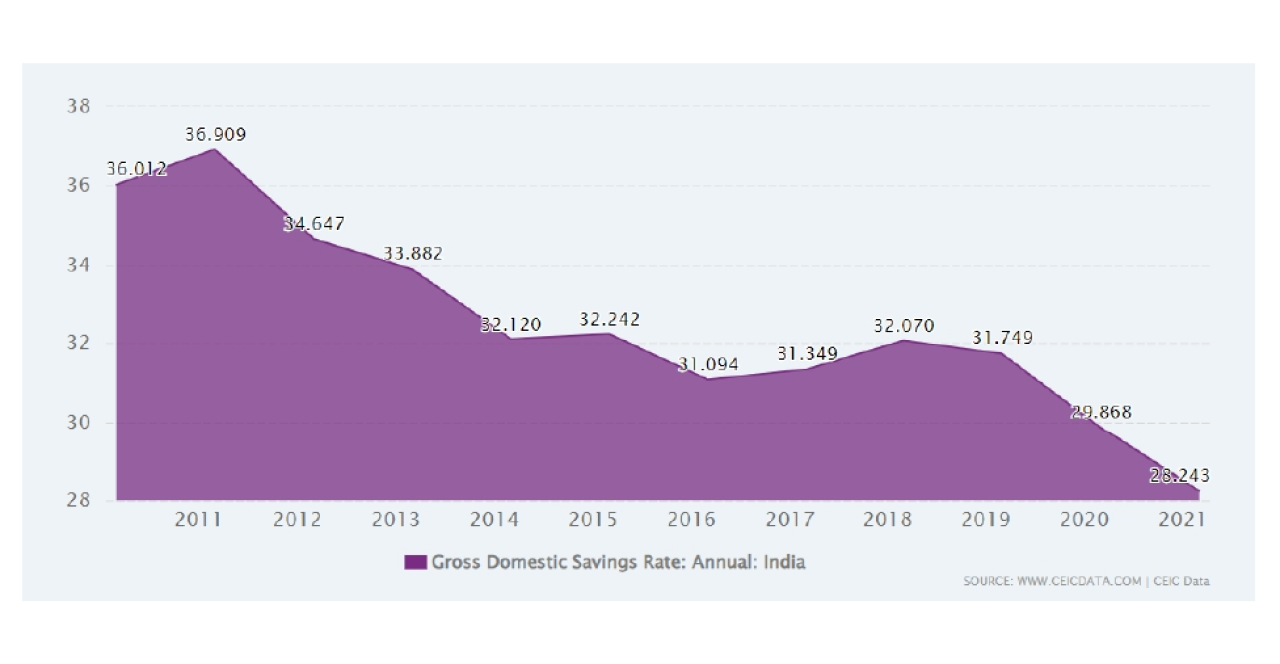

Domestic savings rate has further declined to 26% in the most recent reporting and is at its lowest ever in 2 decades! The relationship between saving, investment & economic growth has been a tough cookie to crack.

All long-run growth theories imply that an economy can grow faster by investing more. An economy with open capital markets, viz., India, may not need higher domestic savings to grow faster as investment can be financed by foreign sources. However, the empirical results suggest that higher domestic saving would boost economic growth. (Read more:https://www.rbi.org.in/Scripts/bs_viewcontent.aspx?Id=2486 )

A decline in savings led growth implies that India is catching up with the technology frontier and hence growth is driven by innovations that are taking place worldwide. Furthermore, there is growing evidence that local firms are now absorbing technology which comes through foreign investment in order to undertake more profitable innovation projects.

THE MICRO: How do we make money?

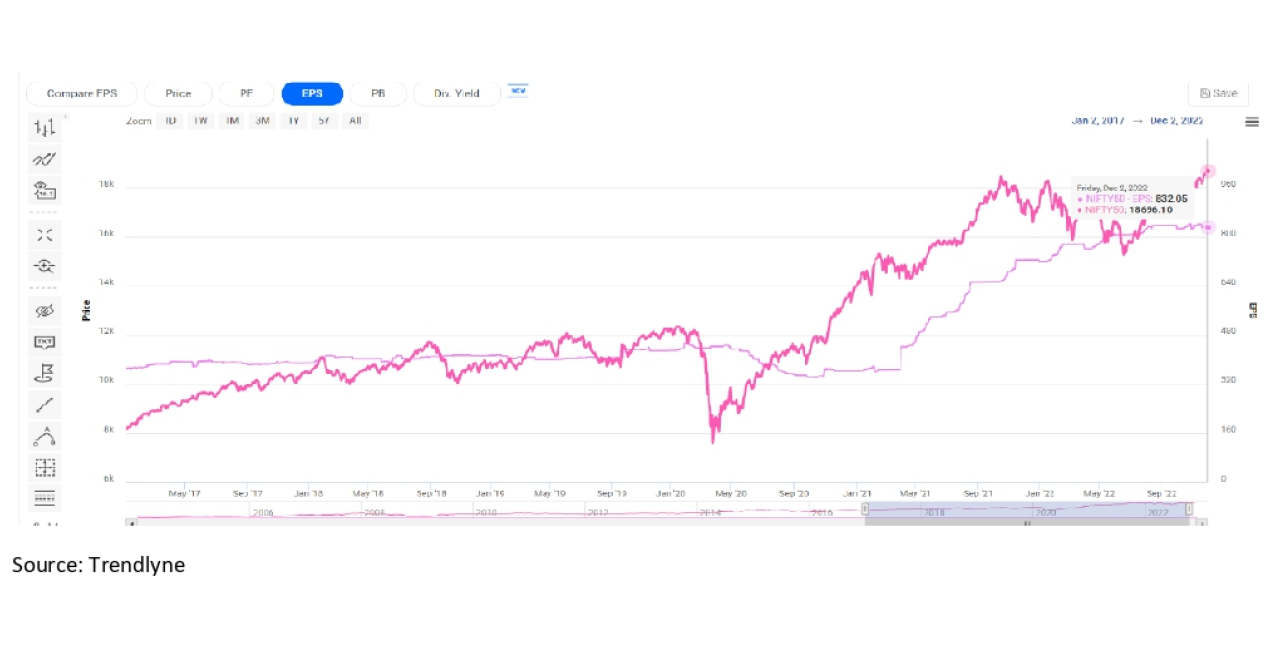

Current Nifty 50 EPS: 832.05. Considering Indian GDP continues to grow at a conservative 6% and Nifty EPS continues to grow at 8%, we are poised for a Nifty EPS of ~Rs.1050 by FY25. It would be fair to assume that Nifty continues to command a reasonable forward PE of 23 times and hence we get an index of 24000! I would refrain from giving time targets when we realise this number on the index but my bet is we get here sooner than a lot of people expect us to! THE BULL MARKET IS HERE TO SURPIRSE EVEN THE BEST OF US!

Stay invested in India.

What should we invest in?

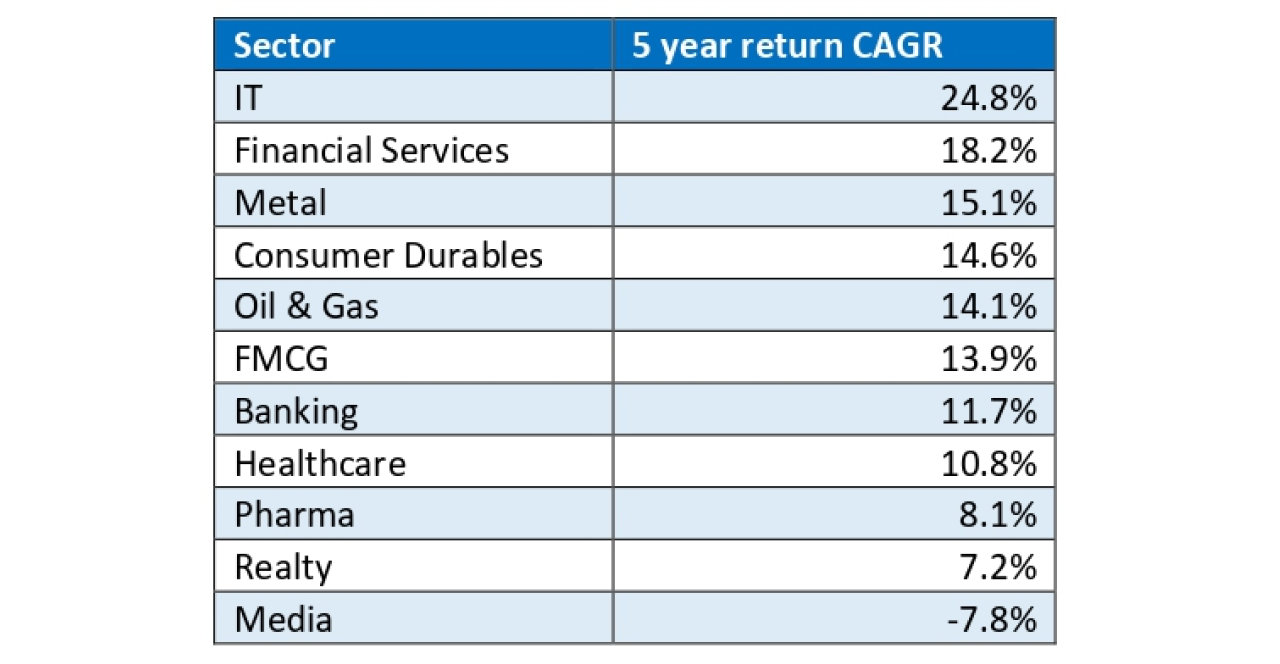

IT: As witnessed in the macro piece written above and also the world around you; there has been a leap of technological adoption post COVID. IT has been a consistent compounder for the last 5 years and I recon this trend is up for continuation. Check out for names which are winning newer logos and deals in the domestic markets. This leg of IT growth might well be fuelled by domestic companies as opposed to export growth in the past.

Financial Services: Although domestic savings a % of GDP might be at its lowest, we are now in line with our western peers (USA: 21%, Europe: 26%). What is encouraging is there HUGE headroom for increase in financial savings within overall savings. Despite a surge in demat accounts since the pandemic, enabling people to hold securities in digital form and trade shares in the share market, the risky investments of households remain lower than their peak in 2016-17. I believe that financial services as a theme is the EASIEST INVESTMENT OPPORTUNITY I have seen in a very long time. This includes the whole gamut of Banking, Insurance, Asset Management Companies, Depository Participants, Exchanges, Housing Finance companies, NBFCs and new age finance companies. Valuation for most of these sectors are at or below their historical averages.

Parth Kotak, CFA, MSc Finance. 4th Dec 2022.