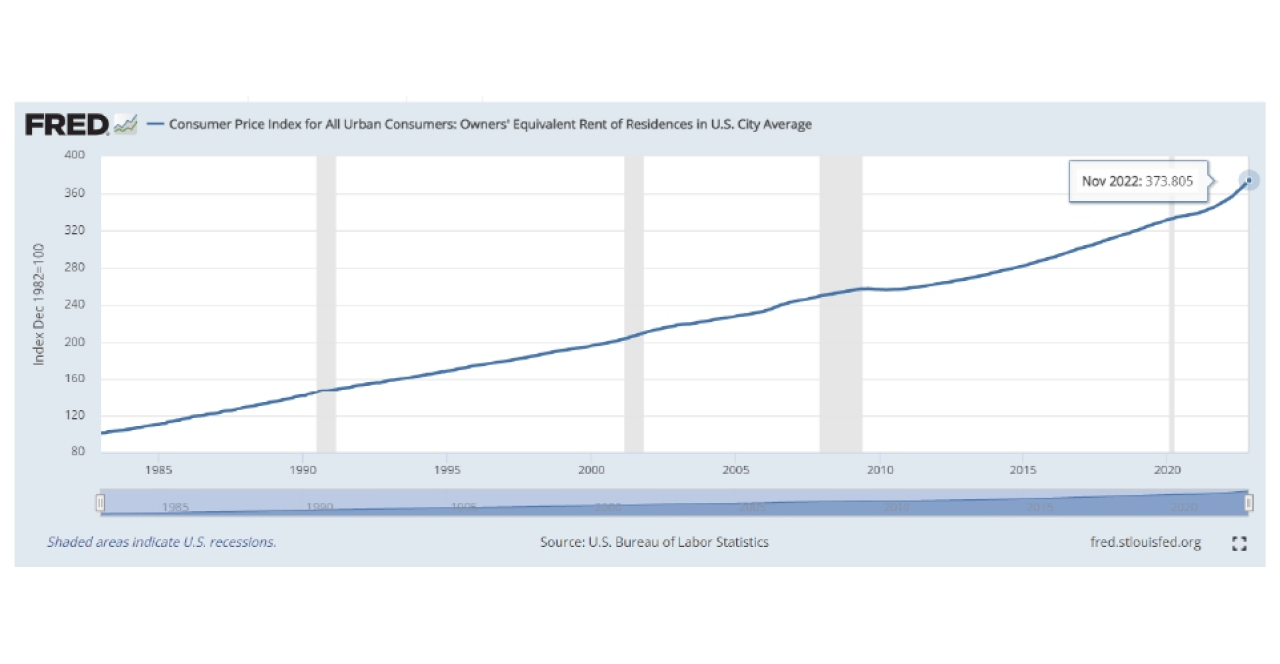

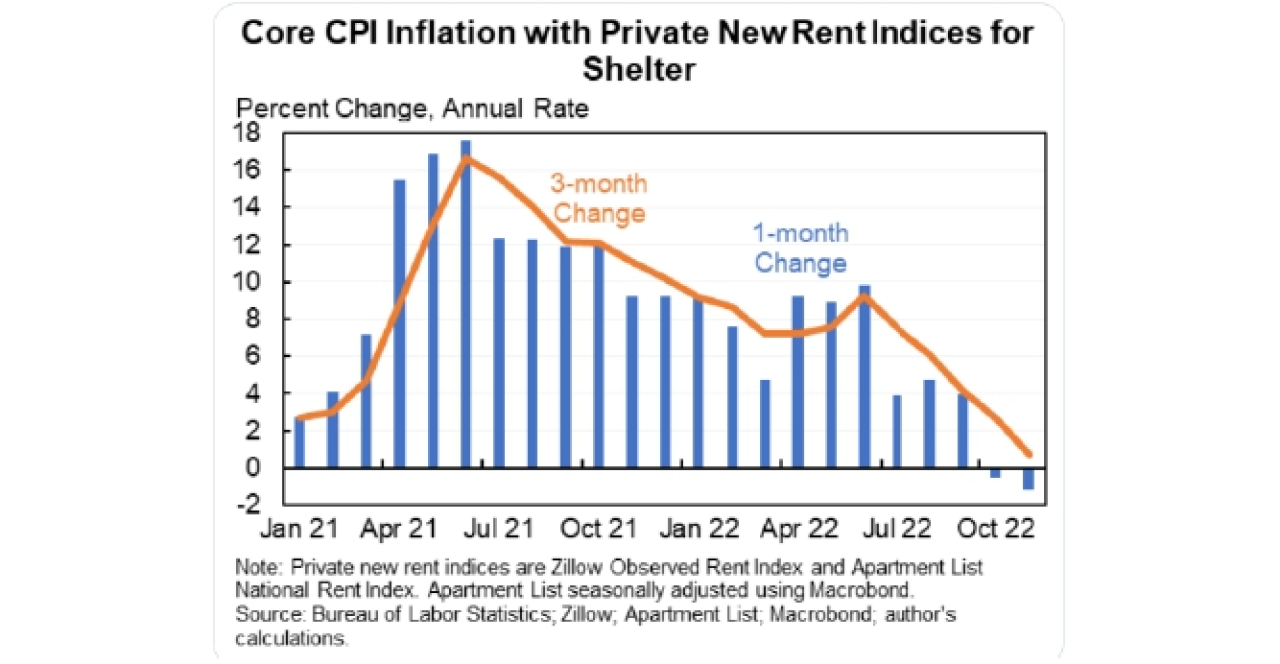

This is a lagging indicator since rents move slowly as new leases are signed. The housing market in the US has cooled down and increased rates have a direct impact on housing prices and rent.

Housing forms 40% of US CPI. Look at this interesting tweet from Harvard economist Jason Furman:

Core CPI will be negative. Core CPI is different from headline inflation at the former does not include food & energy. There is no prize for guessing what the Fed’s stance will be once inflation is in control.

As for energy, I direct you to ever interesting & thought provoking Michael Green. His analysis on Oil is on point! https://michaelwgreen.substack.com/p/what-happens-to-oil-if-china-re-opens

China has become a major driving force for global growth. During the 2013-2021 period, its contribution to global economic growth averaged 38.6 percent, higher than that of the Group of Seven countries combined. On the industrial front, the country's main industrial product output has risen steadily. The output of crude steel, coal, power, cement, fertilizer, automobiles, microcomputers, and mobile phones led the world.

As China re-opening proves inflationary due to their herculean commodity demand, it will also ease cost pressure by being the low-cost producer it always was.

What could be a double whammy is China re-opening at full scale coincides with inflation coming to a halt.

Let’s be clear; global macros are extremely dynamic and it is difficult for anyone to predict with certainty what’s about to come.

THE MICRO: How do we make money?

The next few months are going to be a roller coaster ride. Nifty has given positive return for the last 7 years. We still don’t have a 8 year positive streak. Will this be the year of reckoning? Also Nifty has always been negative in the year before elections. There is a market wide belief that current year’s budget will be sombre as we go all guns blazing the year after.

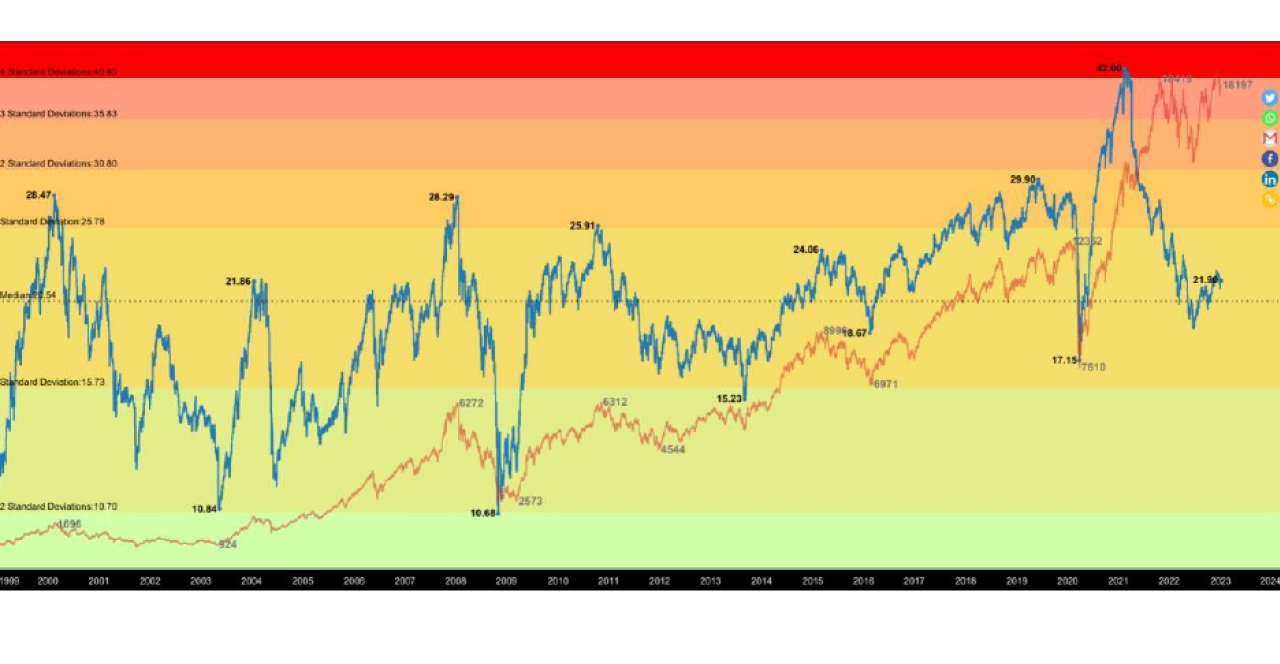

Should you be afraid? Or sit on cash? NO. I have no second thoughts about this being a golden decade for India. Morgan Housel made a strong point in his book The Psychology of Money. He called it ‘Confounding Compounding’: “The most powerful and important book should be called Shut Up and Wait. It’s just a one page with a long-term chart of economic growth.” I have just that for you. Nifty’s chart with its PE ratio.

Blue Line: Nifty PE. Red Line: Nifty Index price

Where should you focus on?

Financials: Financials will continue to perform in tandem with the overall economy. Banks have cleaned up their balance sheets and will continue to exhibit growth in the quarters to come. Apart from banks, we might continue to see growth in both life and general insurance companies. We might want to be selective as valuations of insurance companies as lot of them have a large chunk of future growth factored in their prices.

IT: I have no doubts that IT companies will lead return CAGR in medium to long term. It would be a good idea to accumulate good quality, innovative and companies with a larger domestic revenue share. IT companies might correct further as recession fears loom large with fed’s tightening policy.

Parth Kotak, CFA, MSc Finance. 2nd Jan 2023.