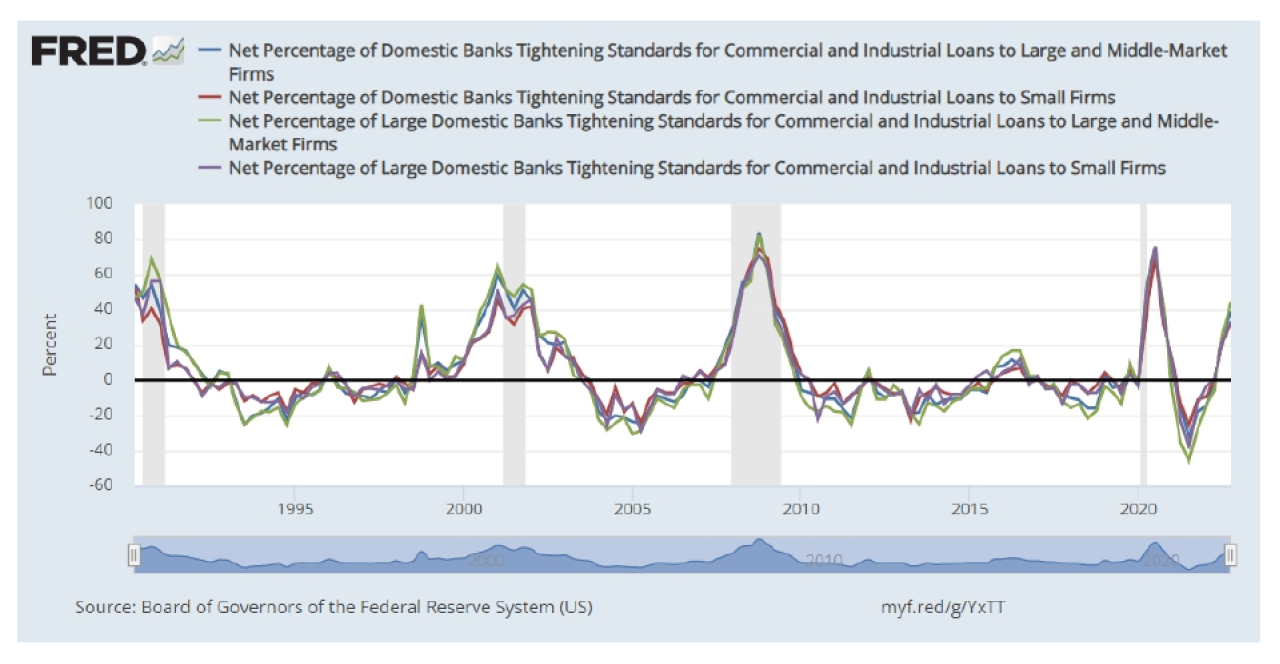

From April 1990 until now, SLOOS (senior loan officer opinion survey) has asked banks about changes in their lending standards. Participating banks are asked about whether and how they have tightened or eased their lending standards in the following wording: “Over the past three months, how have your bank’s credit standards for approving loans changed?”

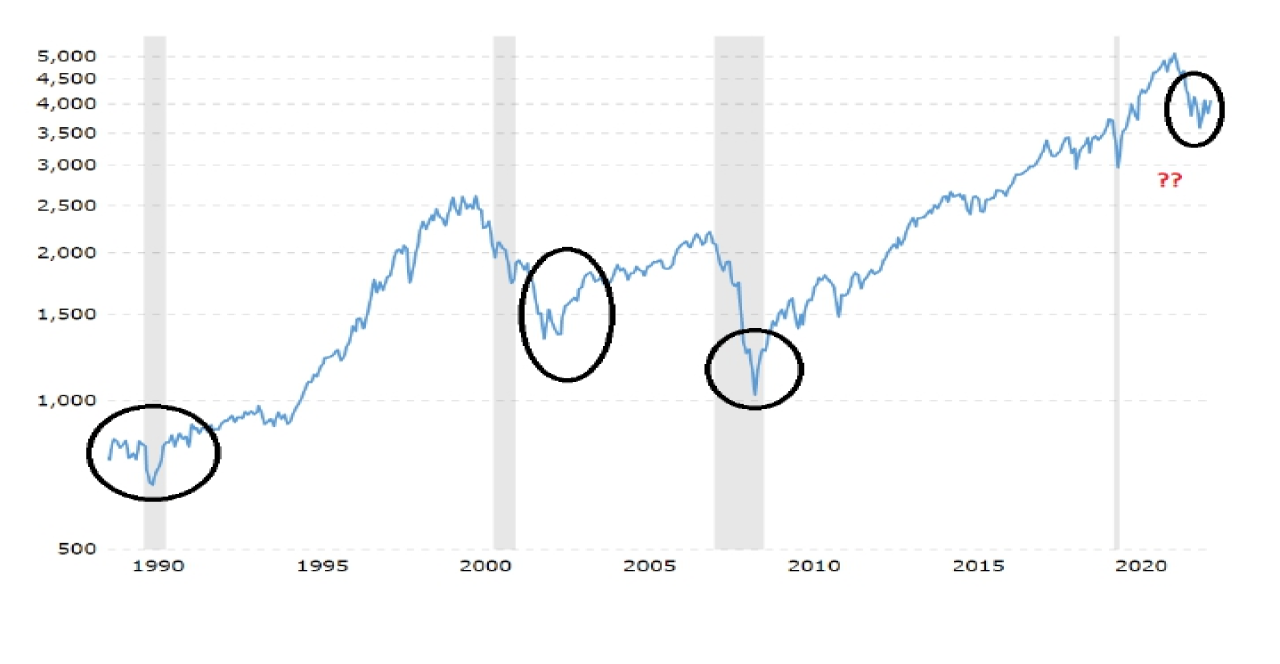

What is extremely interesting here that the S&P 500 Index tends to make a low after the SLOOS peaks.

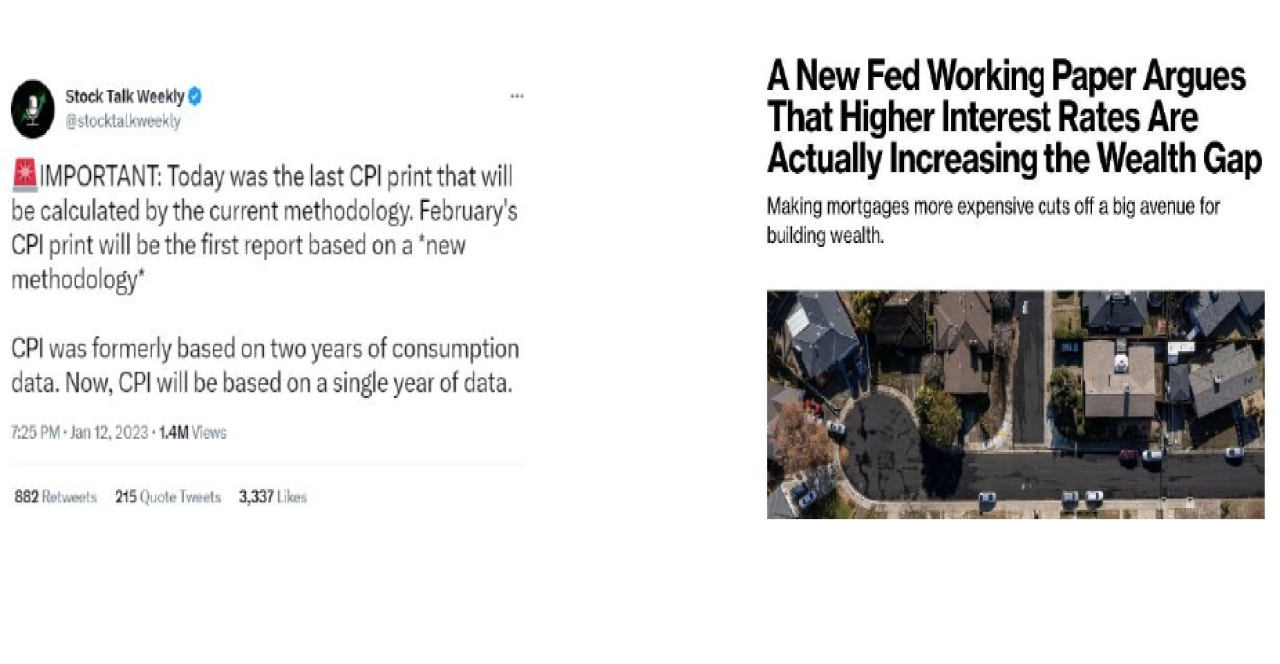

The SLOOS peaks as the percentage of participants (currently 124 domestic banks, US branches & agencies of foreign banks) reaches close to 80%. It seems we are fast approaching that number and should see further dampening is lending sentiments in Q1. This will coincide with Fed changing their stance on the rate hikes. There is enough evidence for the FED scrambling to find the exit door.

THE MICRO: How do we make money

It’s a question of when and not if for the FED to start printing. The current round of quantitative easing will break things. There is a HUGE possibility Fiat debases and limited supply asset classes go over the roof. Equities, Real Estate & Crypto Assets will appreciate

BABURU KEIKI, ‘bubble economy’ refers to the economic bubble in Japan from 1986 to 1991. By the end of 1991, commercial land prices rose 300%, industrial land prices rose 200%, NIKKEI rose by more than 220%. We have seen this episode before and I believe we will see a repeat of this albeit on a global scale

All asset prices, revert to their mean in the long run. But the biggest alpha lies in excess.

What to focus on? It’s not rocket science.

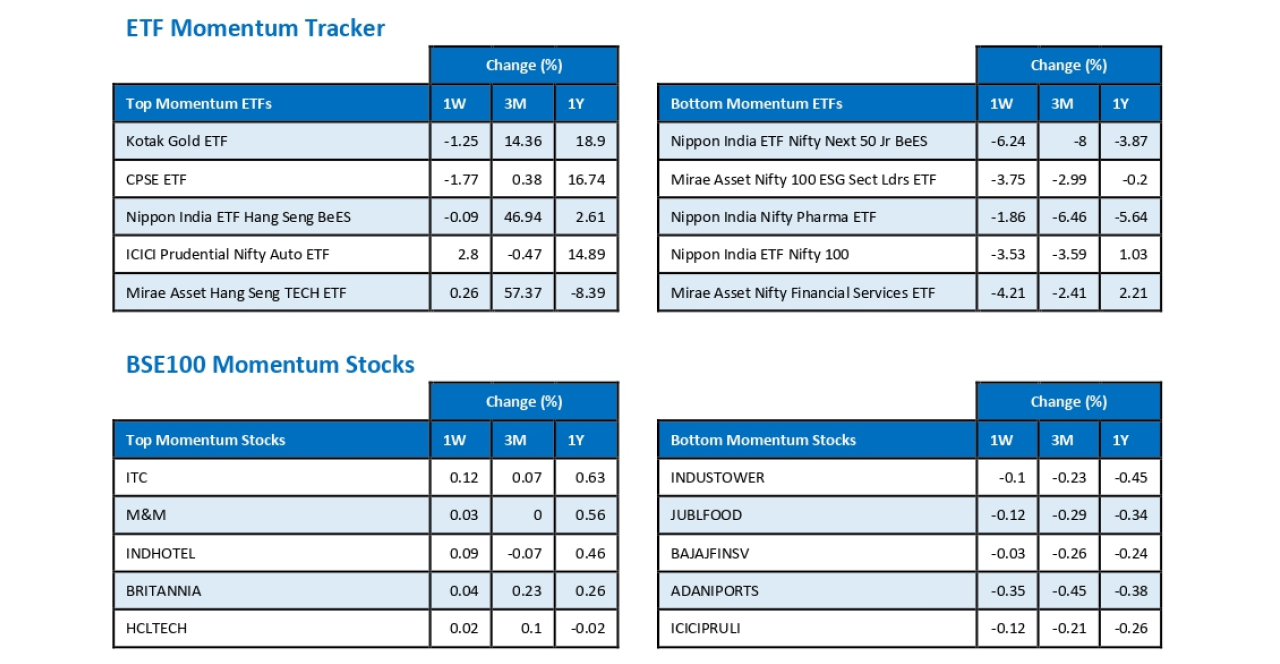

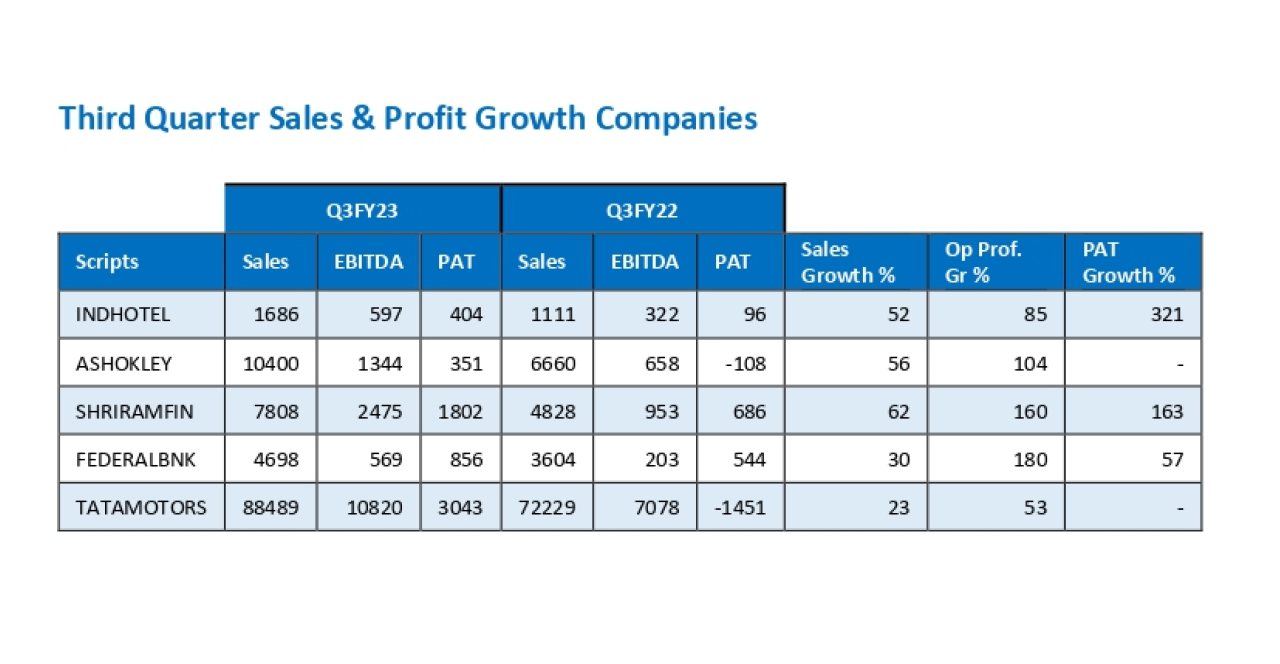

Financials: An economy cannot grow without assistance from its financial system. Credit growth will propel banks and NBFCs. Asset price increases will help investment companies and platforms. The way I would allocate assets is to allocate to the highest growth companies within financials in times of Uptrend and pivot back to strong, safe and too big to fail names in times of downtrend.

IT: These companies have the potential to generate extraordinary profits in the shortest of times. There is a reason why most Unicorns Are Tech companies. Again, my belief is the highest alpha will be on the unlisted space. Even technologies which are not particularly Tech companies (EVs for example) will benefit greatly during these times.

Parth Kotak, CFA, MSc Finance.28th Jan 2023.